WhatsApp Business and Messaging Apps for Insurance

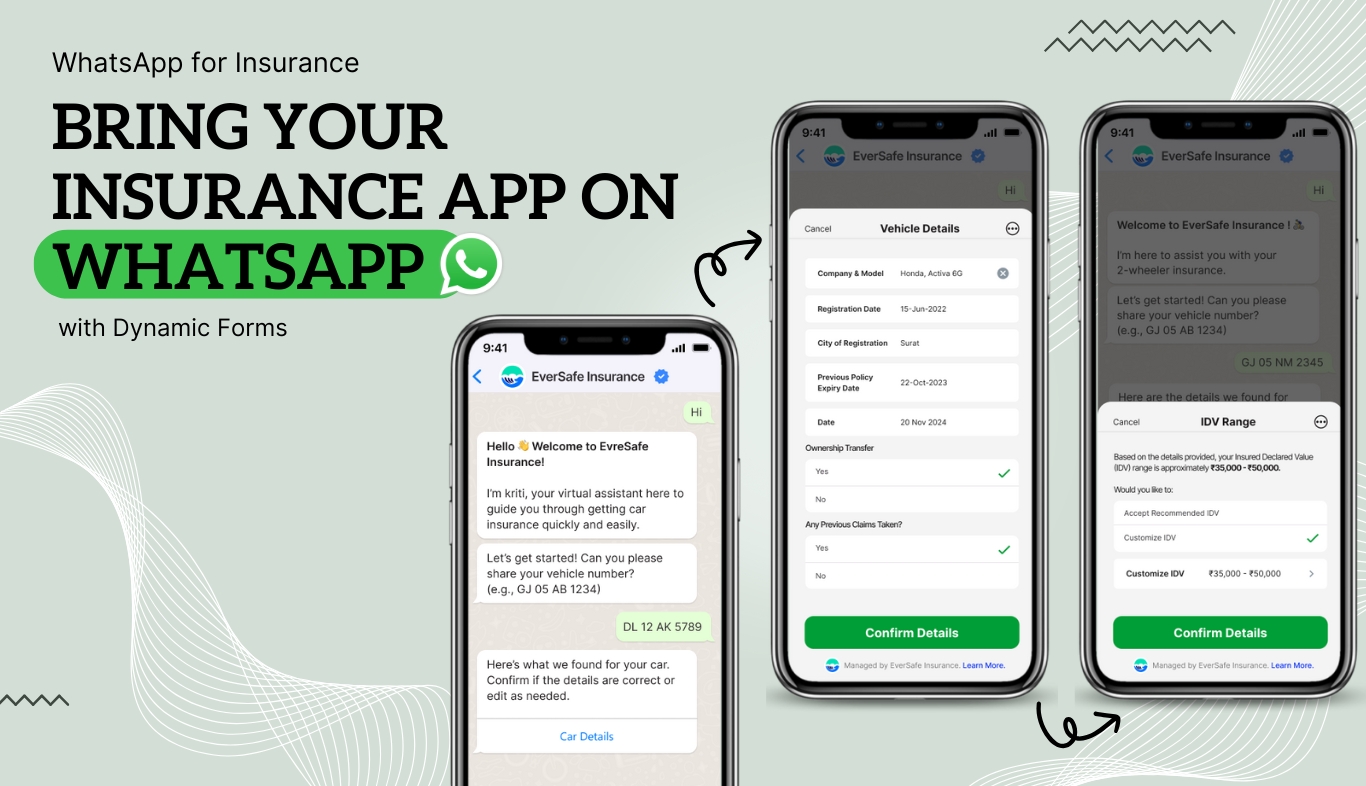

WhatsApp Business has emerged as a transformative communication platform for the insurance industry, enabling companies to deliver faster, more personalised, and more efficient customer service. By leveraging the WhatsApp Business API and integrated messaging solutions, insurers can streamline operations, enhance customer engagement, and build lasting relationships with policyholders.

Key Advantages for Insurance Companies

Secure and Accessible Communication

WhatsApp Business prioritises data security with end-to-end encryption, ensuring the confidentiality of sensitive information and compliance with data protection regulations like GDPR. This secure foundation allows insurers to build trust with clients while handling critical insurance transactions and sensitive policy information.

Real-Time Customer Support

The platform enables insurers to provide instant assistance during critical moments in the customer journey. Whether addressing claims, providing quick quotes, or assisting with policy renewals, WhatsApp ensures that customer support remains accessible and responsive when needed most. Unlike traditional communication channels, WhatsApp creates a real-time dialogue between insurers and customers, allowing policyholders to ask questions, share feedback, and resolve issues instantly.

Cost Efficiency

WhatsApp represents an economical approach to customer response management, reducing the need for lengthy phone calls and follow-ups. By automating routine communications and support processes, insurance companies can significantly lower operational costs while maintaining service quality.

Core Use Cases in Insurance

Claims Processing and Automation

WhatsApp streamlines the entire claims journey through automated processes including customer authentication, documentation submission, claim tracking, and real-time updates. Clients can submit documents, photos, and updates instantly through the app, expediting processes and improving the customer experience. By integrating First Notice of Loss (FNOL) and claims automation into WhatsApp, customers can submit documents and photos in real-time without endless back-and-forth emails or lengthy phone conversations.

Policy Management and Renewals

Insurers can automate reminders for premium payments and policy renewals, making it easier to retain customers and improve overall retention rates. WhatsApp enables the sending of policy renewal reminders, updates, and important information, ultimately building trust and enhancing client loyalty. Customers can also easily update their coverage, add beneficiaries, or make other adjustments through simple chatbot interactions.

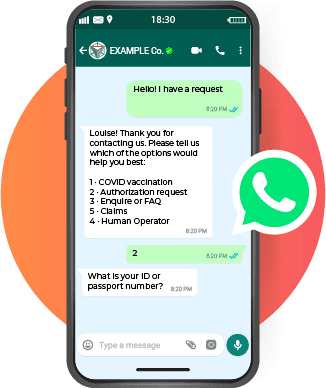

Customer Service and Support

WhatsApp enables insurance companies to respond promptly to customer inquiries and provide individual support. By integrating chatbots, frequently asked questions can be answered automatically, and if necessary, forwarded to live agents, leading to faster processing of requests and higher customer satisfaction. The platform offers 24/7 support for policy assistance, claim tracking, and queries, ensuring convenience and satisfaction for policyholders.

Quote Generation and Sales

Insurance companies can use WhatsApp to reach potential customers, qualify leads quickly, and provide personalised policy recommendations. The platform facilitates the sale of new products and services, including payment options, and enables assisted sales support via live conference with advisors.

Rich Media and Document Capabilities

WhatsApp's multimedia capabilities significantly enhance the customer experience. Insurers can share policy documents, claim forms, explainer videos, and other crucial documents through images, videos, and file sharing, simplifying processes for clients and prospects. Digital ID cards can be delivered directly through WhatsApp, eliminating the need for physical insurance cards. This transparency and accessibility makes the customer journey more efficient and user-friendly.

Advanced Features and Automation

Intelligent Chatbots and AI Agents

WhatsApp Business supports AI-driven chatbots and intelligent agents that provide seamless interactions while reducing the need for manual interventions. These systems can handle routine inquiries, guide customers through processes, and escalate complex issues to human agents when necessary.

Fraud Detection and Security Alerts

The platform enables insurers to detect suspicious activities and alert clients through WhatsApp, helping prevent fraud and protect both the company and policyholders. Automated alerts and notifications keep customers informed of important updates and potential risks.

Payment Integration

WhatsApp Pay and features powered by WhatsApp Business API enable insurers to simplify transactions, allowing premium payments and claim settlements directly within the chat interface. This integration streamlines the contracting workflow and reduces friction in the payment process.

Operational Benefits

Streamlined Customer Engagement

By offering policy information, claim forms, and other crucial documents through WhatsApp's multimedia capabilities, insurers can simplify the process for clients and prospects. The ability to share rich media enhances transparency and makes the customer journey more efficient.

Reduced Response Times

Instead of manually chasing clients for documents, insurers can automate requests for photos of vehicle damage or policy details, all within WhatsApp. This cuts down on delays and significantly improves response times compared to traditional email or phone-based processes.

Enhanced Customer Retention

WhatsApp fosters ongoing engagement with clients through personalised communication, enabling insurers to send tailored offers, policy updates, and renewal reminders. This personalised approach makes customers feel valued and in control of their coverage, ultimately building loyalty and improving retention rates.

Implementation Considerations

Insurance companies implementing WhatsApp Business solutions should ensure compliance with data protection regulations before going live. The platform works best when integrated directly into existing software systems, enabling seamless customer service through the popular messenger service. Many insurers partner with official WhatsApp Business Service Providers to access the full capabilities of the WhatsApp Business API and ensure proper implementation and compliance.

WhatsApp Business has proven to be a game-changer for the insurance industry, enabling companies to unlock better customer service, reduce operational costs, and streamline claims handling while maintaining security and compliance standards.

WebSeoSG offers the highest quality website traffic services in Singapore. We provide a variety of traffic services for our clients, including website traffic, desktop traffic, mobile traffic, Google traffic, search traffic, eCommerce traffic, YouTube traffic, and TikTok traffic. Our website boasts a 100% customer satisfaction rate, so you can confidently purchase large amounts of SEO traffic online. For just 40 SGD per month, you can immediately increase website traffic, improve SEO performance, and boost sales!

Having trouble choosing a traffic package? Contact us, and our staff will assist you.

Free consultation