Omnichannel marketing strategies for insurance brokers focus on delivering a seamless, integrated, and personalized customer experience across all digital and physical touchpoints. Here are the key strategies and best practices:

1. Break Down Channel Silos

- Integrate all sales and support channels (online, mobile, in-person, phone, social media) so customer data is shared and accessible.

- Use a centralized CRM system to track every interaction, ensuring a 360-degree view of the customer journey.

- Enable customers to start a process on one channel (e.g., website) and continue on another (e.g., agent or mobile app) without repeating information.

2. Ensure Consistent Messaging and Branding

- Maintain a unified brand voice and message across all channels (website, social media, email, physical offices).

- Align product information, pricing, and promotions so customers receive the same experience regardless of how they interact.

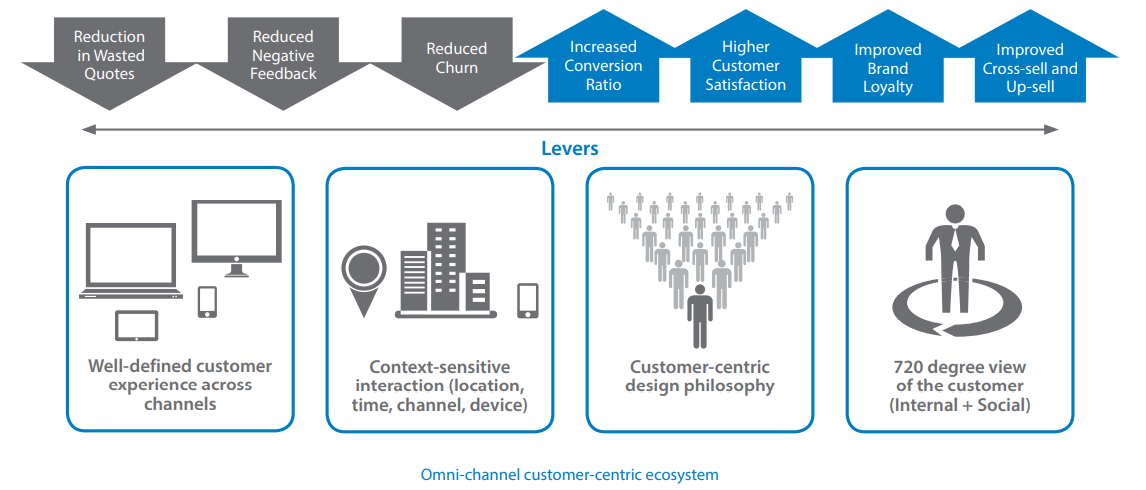

3. Leverage Data for Personalization

- Collect and analyze customer data from all touchpoints to understand preferences, behaviors, and pain points.

- Use this data to personalize communications, recommend relevant products, and improve cross-selling and upselling opportunities.

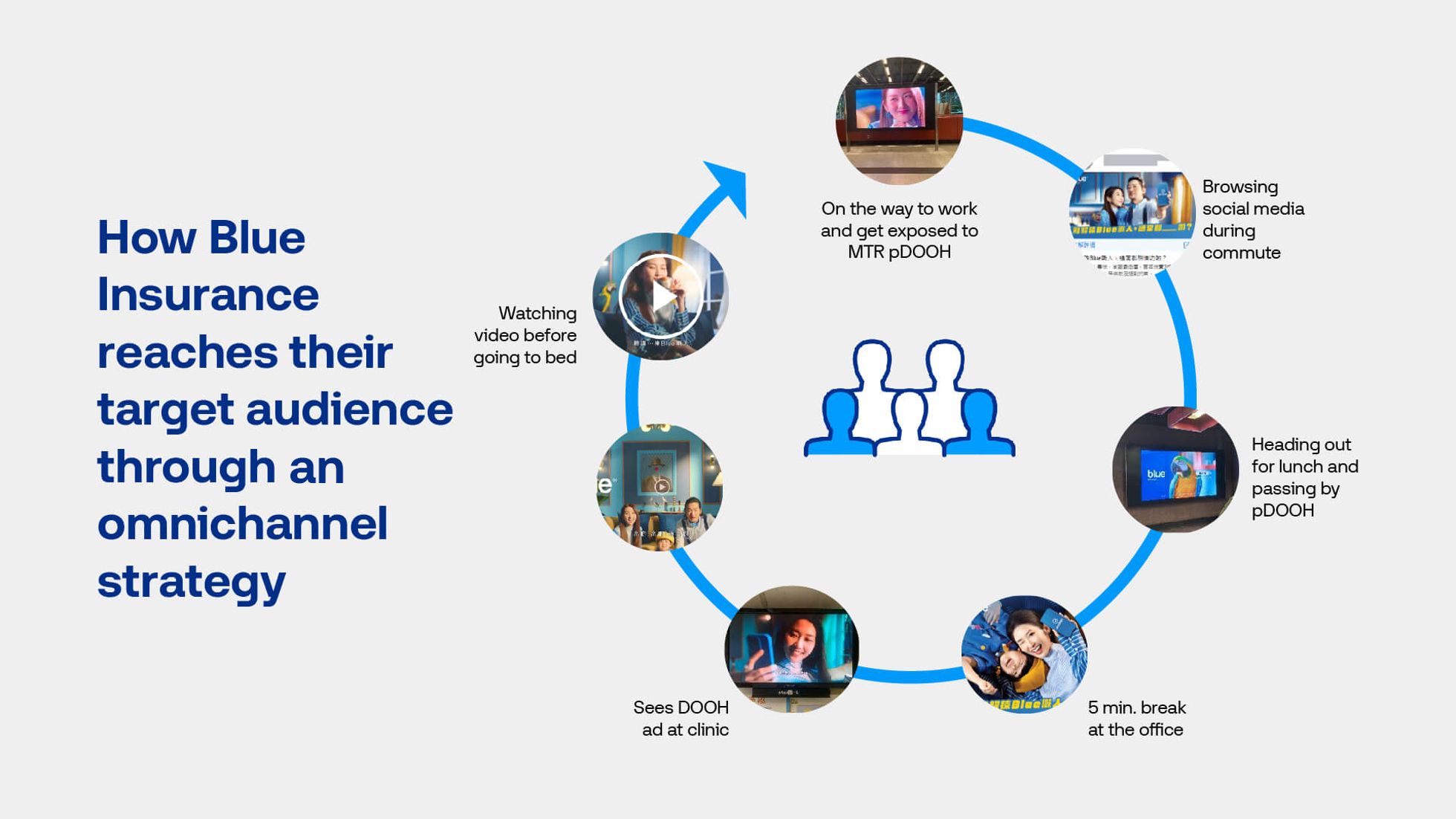

4. Enable Seamless Customer Journeys

- Simplify the buying process with intuitive digital tools (e.g., online portals, mobile apps, chatbots).

- Allow customers to compare policies, get quotes, and manage claims easily across channels.

- Provide self-service options for routine tasks, while ensuring easy access to agents for complex needs.

5. Reward Collaboration Across Channels

- Shift from rewarding only the “goal scorer” (the agent who closes the sale) to also rewarding the “assist maker” (the channel or agent who generates or passes on leads).

- Incentivize agents and teams to collaborate and pass leads to the most appropriate channel for the customer.

6. Use Omnichannel Communication Tools

- Engage customers through multiple channels: SMS, mobile apps, messaging apps, email, website, and physical offices.

- Automate notifications and recommendations based on customer behavior and policy type.

7. Focus on Customer Loyalty and Retention

- A seamless omnichannel experience increases customer satisfaction, loyalty, and retention.

- Use data to identify at-risk customers and intervene with targeted offers or support.

8. Ensure Compliance and Consistency

- Omnichannel systems help track all customer interactions, making it easier to ensure regulatory compliance and consistent messaging across channels.

9. Adopt Consumer-Facing Technology

- Offer client portals, online enrollment tools, and digital document management to streamline processes.

- Use chatbots and AI for instant support and guidance.

10. Monitor and Optimize Performance

- Track customer journeys and marketing ROI across all channels.

- Continuously refine strategies based on data insights and customer feedback.

By implementing these omnichannel marketing strategies, insurance brokers can enhance customer experience, boost sales, and stay competitive in a rapidly evolving market.

WebSeoSG offers the highest quality website traffic services in Singapore. We provide a variety of traffic services for our clients, including website traffic, desktop traffic, mobile traffic, Google traffic, search traffic, eCommerce traffic, YouTube traffic, and TikTok traffic. Our website boasts a 100% customer satisfaction rate, so you can confidently purchase large amounts of SEO traffic online. For just 40 SGD per month, you can immediately increase website traffic, improve SEO performance, and boost sales!

Having trouble choosing a traffic package? Contact us, and our staff will assist you.

Free consultation