AI and chatbot implementation in insurance client service is transforming how insurers interact with customers, streamline operations, and enhance overall satisfaction. Here’s a comprehensive overview of how AI and chatbots are being used in insurance client service:

Key Benefits of AI and Chatbot Implementation

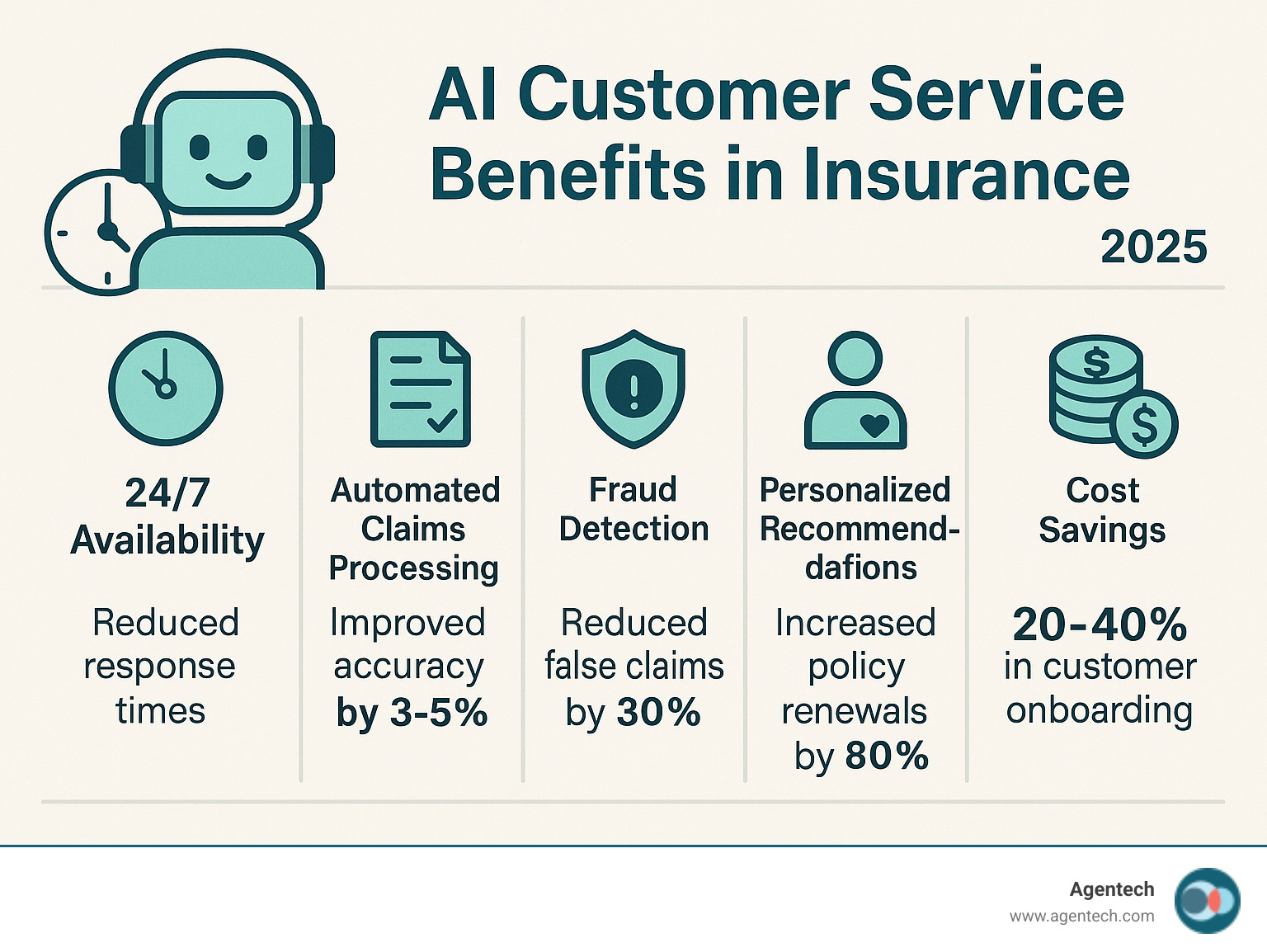

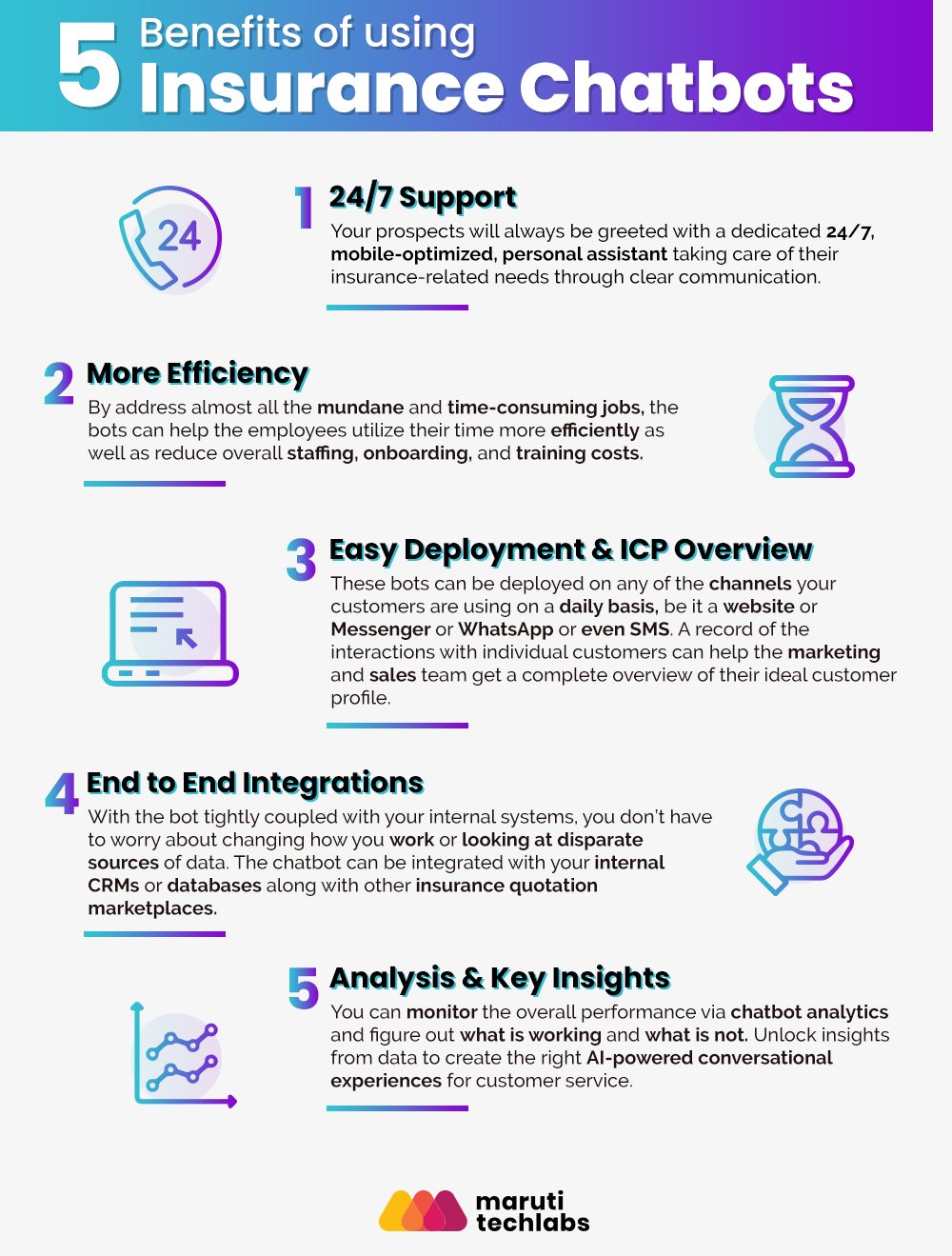

- 24/7 Customer Support: Chatbots provide round-the-clock assistance, allowing customers to get instant answers to policy questions, claims status, and billing inquiries at any time, regardless of time zones.

- Faster Claims Processing: AI-powered chatbots can automate the claims process, reducing processing time by up to 75–90%. They collect necessary details, verify documents, and provide real-time updates, minimizing delays and errors.

- Improved Customer Satisfaction: Immediate responses and self-service options lead to higher customer satisfaction. Studies show that up to 87% of customers value fast claims processing, and 74% prefer chatbots for simple questions.

- Cost Reduction: Automation of routine tasks (such as answering FAQs, processing claims, and managing policies) can reduce operational costs by 30–65%.

- Fraud Detection: AI chatbots use advanced algorithms to detect suspicious activity and flag potential fraud, improving security without compromising the customer experience.

- Personalized Service: Chatbots leverage customer data to offer personalized policy recommendations, reminders, and targeted marketing messages, enhancing the relevance and value of interactions.

- Data-Driven Insights: Every chatbot interaction generates valuable data, helping insurers identify trends, common issues, and service gaps, which can inform product development and service improvements.

Common Use Cases

- Policy Information and FAQs: Customers can instantly access details about their coverage, premiums, and policy documents.

- Claims Management: Chatbots guide customers through the claims process, collect required information, and provide real-time updates.

- Customer Onboarding: New policyholders receive assistance with coverage details, premium payments, and documentation.

- Lead Generation and Marketing: Chatbots interact with website visitors, qualify leads, and deliver personalized marketing messages and product recommendations.

- Feedback Collection: Chatbots gather customer feedback and suggestions, helping insurers refine their products and services.

- Proactive Communication: Chatbots send reminders about policy benefits, payment deadlines, and coverage optimization.

Implementation Considerations

- Multi-Channel Deployment: Chatbots can be deployed across websites, mobile apps, WhatsApp, Facebook Messenger, SMS, and other platforms.

- Natural Language Processing (NLP): Advanced NLP enables chatbots to understand and respond to customer inquiries accurately, learning and improving over time.

- Human Oversight: While chatbots handle routine tasks, it’s important to maintain access to live support for complex cases, ensuring a balance between automation and the human touch.

- Compliance and Ethics: Insurers must ensure that chatbot implementations comply with data privacy regulations and ethical standards.

Real-World Impact

- Increased Efficiency: Automation of repetitive tasks frees up human agents to focus on more complex and empathetic interactions.

- Enhanced Availability: Chatbots ensure that support is available during peak periods and after hours, improving service continuity.

- Competitive Advantage: Insurers leveraging AI and chatbots can deliver faster, smarter, and more personalized customer experiences, staying ahead in a rapidly evolving industry.

In summary, AI and chatbot implementation in insurance client service is driving significant improvements in efficiency, customer satisfaction, and operational cost savings, while also enabling insurers to offer more personalized and proactive support.

WebSeoSG offers the highest quality website traffic services in Singapore. We provide a variety of traffic services for our clients, including website traffic, desktop traffic, mobile traffic, Google traffic, search traffic, eCommerce traffic, YouTube traffic, and TikTok traffic. Our website boasts a 100% customer satisfaction rate, so you can confidently purchase large amounts of SEO traffic online. For just 40 SGD per month, you can immediately increase website traffic, improve SEO performance, and boost sales!

Having trouble choosing a traffic package? Contact us, and our staff will assist you.

Free consultation