Regional budget customization for Southeast Asian gaming markets involves tailoring marketing, development, and operational budgets to the distinct characteristics, consumer behaviors, and economic conditions of each country within Southeast Asia (SEA). This approach is critical due to the region's diversity in gaming preferences, infrastructure, and monetization potential.

Key points for effective budget customization in SEA gaming markets include:

-

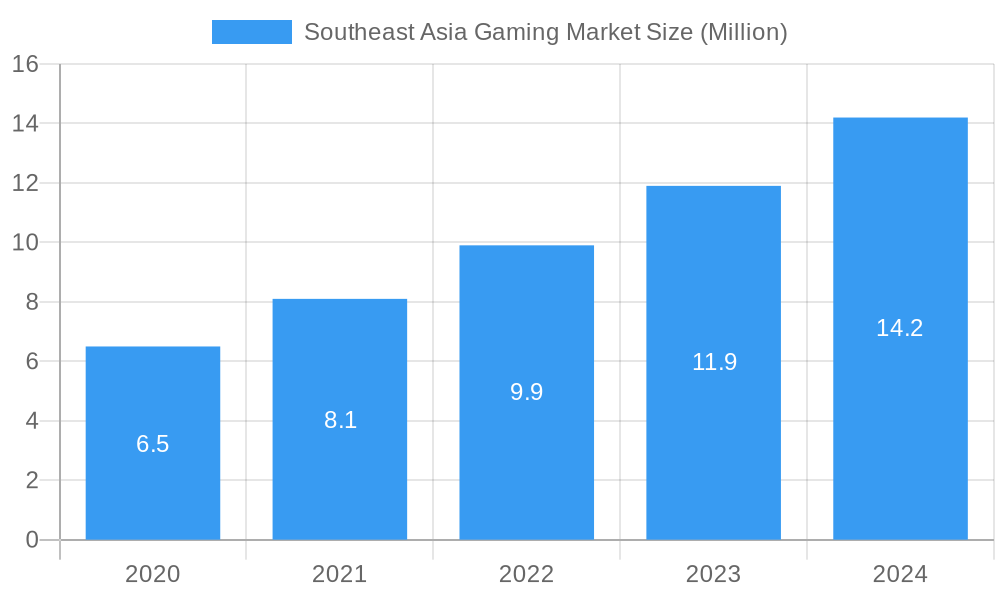

Market Size and Growth Variability: Southeast Asia's gaming market is large but unevenly developed. For example, Indonesia leads in mobile game downloads with 870 million in Q1 2025, followed by the Philippines and Vietnam, reflecting different user bases and growth rates. The overall market is valued at around $14.8 billion in 2025 with a modest CAGR of 0.19%, indicating maturity in some markets but growth potential in others.

-

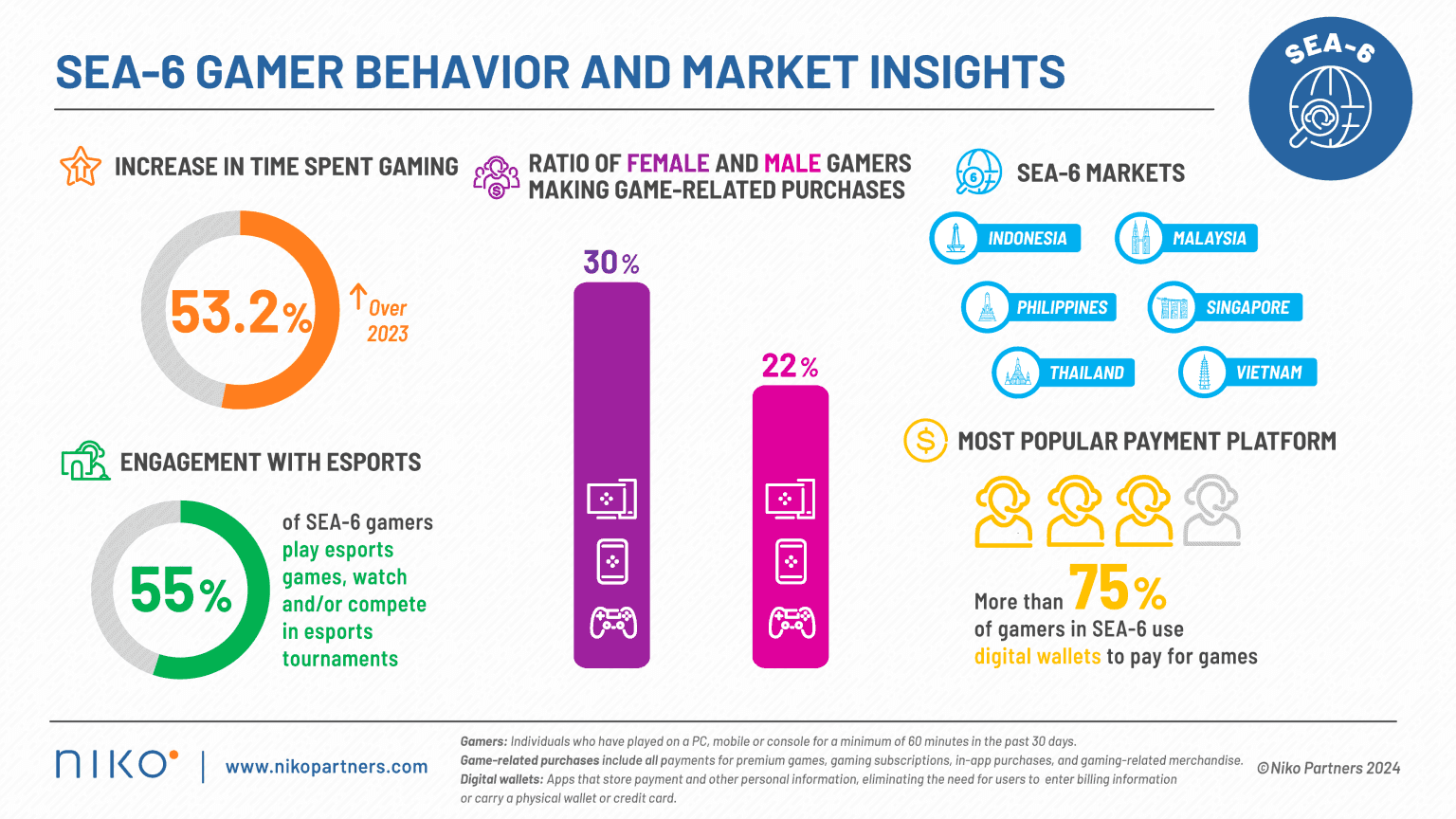

Mobile-First Focus: The region is predominantly mobile gaming-centric, with nearly 55% of gaming hours spent on mobile devices. This necessitates budget allocation prioritizing mobile game development, marketing, and esports content tailored for mobile consumption.

-

Localization and Cultural Customization: Successful games embed local cultural elements and characters to resonate with regional audiences. For example, Mobile Legends: Bang Bang (MLBB) includes region-inspired heroes like Pacquito (Filipino boxer Manny Pacquiao) and Kadita (Indonesian mythology), which enhances player engagement and loyalty. Budgets should allocate resources for local content creation, language support, and culturally relevant marketing campaigns.

-

Infrastructure and Regulatory Considerations: Budgeting must account for varying internet infrastructure quality and regulatory environments across SEA countries. Investments in optimizing game performance for lower bandwidth and compliance with local laws are essential.

-

Monetization Strategies: Despite high download volumes (1.93 billion in Q1 2025), SEA ranks seventh globally in in-app purchase revenue ($625 million), indicating a gap between user engagement and monetization. Budgets should support initiatives to improve payment infrastructure integration and user acquisition strategies focused on increasing average revenue per user (ARPU).

-

Country-Specific Market Approaches: Indonesia serves as a "traffic engine" due to its large Android user base and social media activity, making it ideal for testing and scaling new games with relatively lower budgets focused on lightweight, viral games. Other countries like Singapore and Malaysia may require different budget allocations reflecting their smaller but more affluent and mature markets.

-

Esports and Streaming Platforms: Budgeting should consider the popularity of esports and preferred content platforms. YouTube dominates esports viewership in SEA, while Twitch is less popular, guiding where to allocate marketing and sponsorship funds.

In summary, regional budget customization in Southeast Asia gaming markets requires a nuanced allocation of resources that reflects mobile-first consumption, cultural localization, infrastructure challenges, and country-specific market dynamics to maximize growth and engagement. This includes prioritizing mobile game development, localized content, payment solutions, and platform-specific marketing strategies tailored to each country’s unique gaming ecosystem.

WebSeoSG offers the highest quality website traffic services in Singapore. We provide a variety of traffic services for our clients, including website traffic, desktop traffic, mobile traffic, Google traffic, search traffic, eCommerce traffic, YouTube traffic, and TikTok traffic. Our website boasts a 100% customer satisfaction rate, so you can confidently purchase large amounts of SEO traffic online. For just 40 SGD per month, you can immediately increase website traffic, improve SEO performance, and boost sales!

Having trouble choosing a traffic package? Contact us, and our staff will assist you.

Free consultation