Competitive Analysis and Benchmarking in Insurance Marketing

Competitive analysis and benchmarking are two interconnected strategic tools that insurance companies use to understand their market position, optimise operations, and drive business growth. While distinct in their focus, these approaches work synergistically to provide a comprehensive framework for decision-making in the insurance sector.

Understanding the Core Concepts

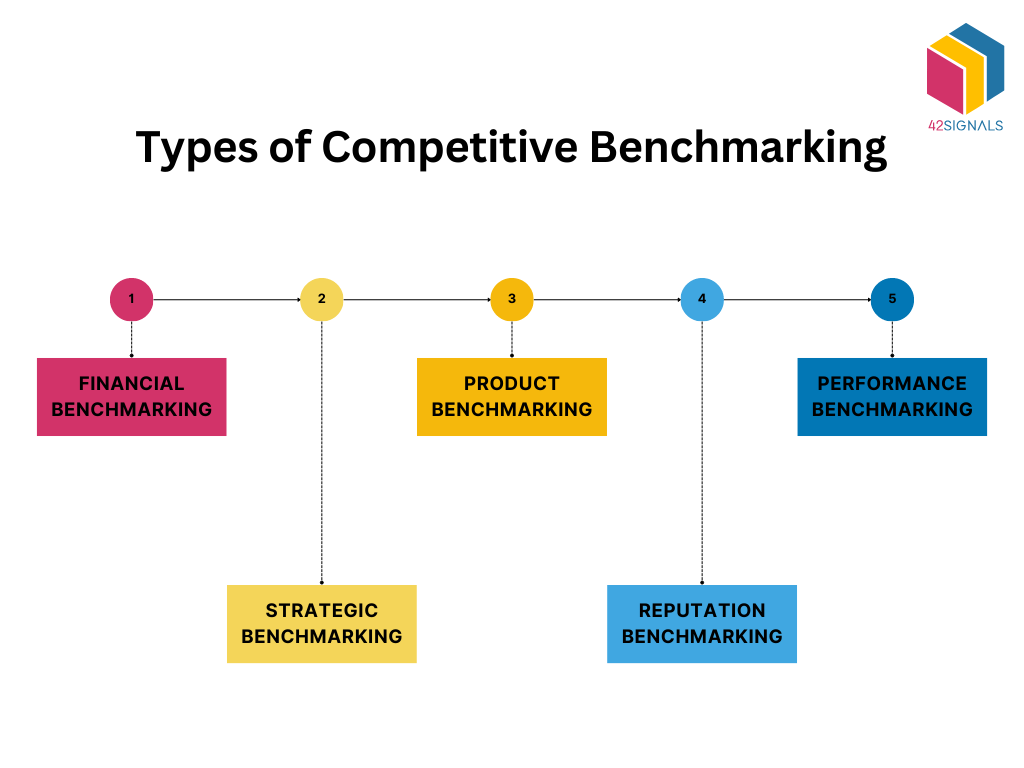

Benchmarking involves comparing a company's processes, performance metrics, and products against industry best practices and standards from other organisations. In insurance, this means measuring performance against industry leaders using key performance indicators (KPIs) such as customer satisfaction, claims processing time, policy renewal rates, and cost efficiency.

Competitive analysis, by contrast, evaluates the strengths and weaknesses of current and potential competitors to understand the broader market landscape. It provides insights into competitor strategies, market positioning, and emerging threats or opportunities.

Key Performance Indicators in Insurance Benchmarking

Insurance companies typically benchmark against several critical metrics:

Financial Performance Metrics include loss ratios (the ratio of incurred losses and loss adjustment expenses to earned premiums), expense ratios, and underwriting profitability. These indicators reveal how effectively a company manages risk and controls costs relative to industry standards.

Operational Metrics encompass claims handling performance, policy processing times, and customer service quality. Comparing these metrics helps identify operational inefficiencies and improvement opportunities.

Market Metrics involve analysing premium levels, policy counts to estimate market share, and customer retention rates. Understanding competitor pricing strategies—whether they position themselves as high-end, mid-market, or budget-friendly—informs strategic positioning decisions.

Strategic Applications in Insurance Marketing

Market Entry and Expansion

When regional carriers consider expanding into new states, rate filing analysis provides crucial competitive intelligence. By examining Personal Auto and Homeowners filings from established carriers, expanding companies can identify market gaps, incumbent competitor strategies, and optimal entry points.

Pricing Optimisation

Insurance companies use competitive analysis to refine pricing strategies. By systematically comparing premium levels across territories and analysing competitor pricing models, carriers can develop competitive responses and justify their rate filings to regulators. This data-driven approach helps companies make informed adjustments that spur profitable growth.

Product Development and Innovation

Competitive analysis reveals emerging coverage trends and market opportunities. When multiple carriers begin offering enhanced cyber liability coverage or specialty products, this signals market demand that requires strategic response. Benchmarking helps companies evaluate whether to develop similar products, improve existing offerings, or adopt new marketing techniques to retain market share.

Customer-Centric Strategy

By analysing competitor customer engagement strategies and shopping data, insurance organisations can craft superior customer service frameworks. Understanding what customers want and what they are willing to pay provides unparalleled clarity on market demand.

The Synergy Between Benchmarking and Competitive Analysis

When used together, these approaches create a robust strategic framework. Benchmarking improves internal processes and performance metrics, whilst competitive analysis reveals external market conditions and competitor strategies. This dual approach ensures insurance entities operate efficiently whilst remaining competitive in a dynamic market.

For example, benchmarking can assess the effectiveness of a marketing campaign relative to industry best practices, whilst competitive analysis provides insights into successful competitor marketing tactics. Combining these approaches enables organisations to refine marketing strategies that are both effective and distinctive.

Practical Implementation

Effective competitive analysis involves several steps: identifying direct and indirect competitors, defining analysis criteria, analysing competitor performance by volume and claims handling, and evaluating profitability. Companies should also conduct SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to understand their competitive position and identify strategic opportunities.

Insurance startups particularly benefit from identifying market gaps and niches that competitors have overlooked. This includes evaluating geographic gaps in competitor coverage and specialty coverages or customer demographics that mainstream providers may be underserving.

By systematically comparing key performance metrics against industry standards, insurance companies can better understand their relative market position, identify areas for improvement, and uncover strategic opportunities that drive overall business performance.

WebSeoSG offers the highest quality website traffic services in Singapore. We provide a variety of traffic services for our clients, including website traffic, desktop traffic, mobile traffic, Google traffic, search traffic, eCommerce traffic, YouTube traffic, and TikTok traffic. Our website boasts a 100% customer satisfaction rate, so you can confidently purchase large amounts of SEO traffic online. For just 40 SGD per month, you can immediately increase website traffic, improve SEO performance, and boost sales!

Having trouble choosing a traffic package? Contact us, and our staff will assist you.

Free consultation