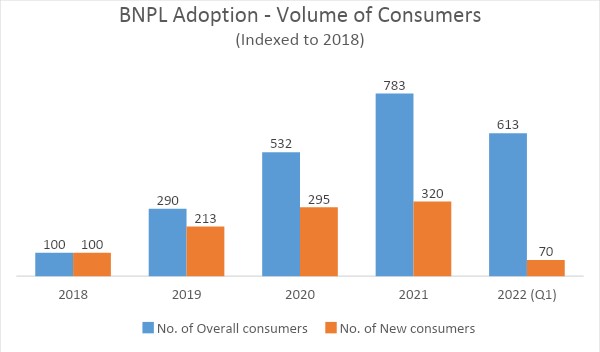

The adoption and growth of alternative payment methods such as Buy Now Pay Later (BNPL) and mobile wallets have been significant and rapidly expanding. BNPL is becoming a mainstream payment option, especially among younger consumers, with the market expected to reach nearly US$1.94 billion by 2030, growing at a compound annual growth rate (CAGR) of around 7.9% from 2025 to 2030. Mobile wallets have also seen strong uptake, supported by national infrastructure and inter-bank collaborations, with millions of users and integration into super apps that provide seamless access to multiple services and payments.

Key points on BNPL adoption and growth:

- BNPL allows consumers to split purchases into interest-free instalments without credit cards, appealing especially to Gen Z and millennials, with up to 77% of Gen Z using BNPL.

- Major BNPL providers include Atome, GrabPay, and SPayLater, with market consolidation occurring through mergers and acquisitions.

- BNPL is widely accepted both online and in physical stores, and providers operate under a voluntary code of conduct to ensure consumer protection and responsible lending.

- The BNPL market is driven by e-commerce growth and changing consumer preferences for flexible payment options.

Key points on mobile wallets:

- Mobile wallets have become essential for digital payments, enabling financial access for many previously underserved consumers and facilitating instant peer-to-peer and cross-border transfers.

- National payment infrastructures like PayNow and FAST enable instant fund transfers between banks and non-bank financial institutions, enhancing convenience and interoperability.

- Cross-border payment linkages, such as between Singapore and neighboring countries, are expanding, reducing reliance on foreign currency conversions and supporting regional digital trade.

- Mobile wallets are evolving beyond payments into platforms for commerce, loyalty, gaming, and financial services, often integrated into super apps.

Together, BNPL and mobile wallets are reshaping the payments landscape by offering flexible, convenient, and inclusive financial solutions that align with digital consumer lifestyles and regional integration trends. Regulatory oversight is expected to increase to ensure responsible use and consumer protection as these markets mature.

WebSeoSG offers the highest quality website traffic services in Singapore. We provide a variety of traffic services for our clients, including website traffic, desktop traffic, mobile traffic, Google traffic, search traffic, eCommerce traffic, YouTube traffic, and TikTok traffic. Our website boasts a 100% customer satisfaction rate, so you can confidently purchase large amounts of SEO traffic online. For just 40 SGD per month, you can immediately increase website traffic, improve SEO performance, and boost sales!

Having trouble choosing a traffic package? Contact us, and our staff will assist you.

Free consultation