Overview of New U.S. Tariffs Affecting Singaporean Exporters

In April 2025, the United States implemented a 10% baseline tariff on imports from Singapore, as well as from 124 other countries, under the International Emergency Economic Powers Act. This tariff applies broadly but excludes certain categories such as pharmaceuticals, semiconductors, energy goods, critical minerals, some IT products, and low-value shipments under US$800. Additionally, sector-specific tariffs under Section 232 of the Trade Expansion Act of 1962 apply to automobiles (25%), steel and aluminium (50%), and copper (50%)—these are in addition to the baseline tariff and affect most economies, including Singapore.

Impact on Singaporean Exporters

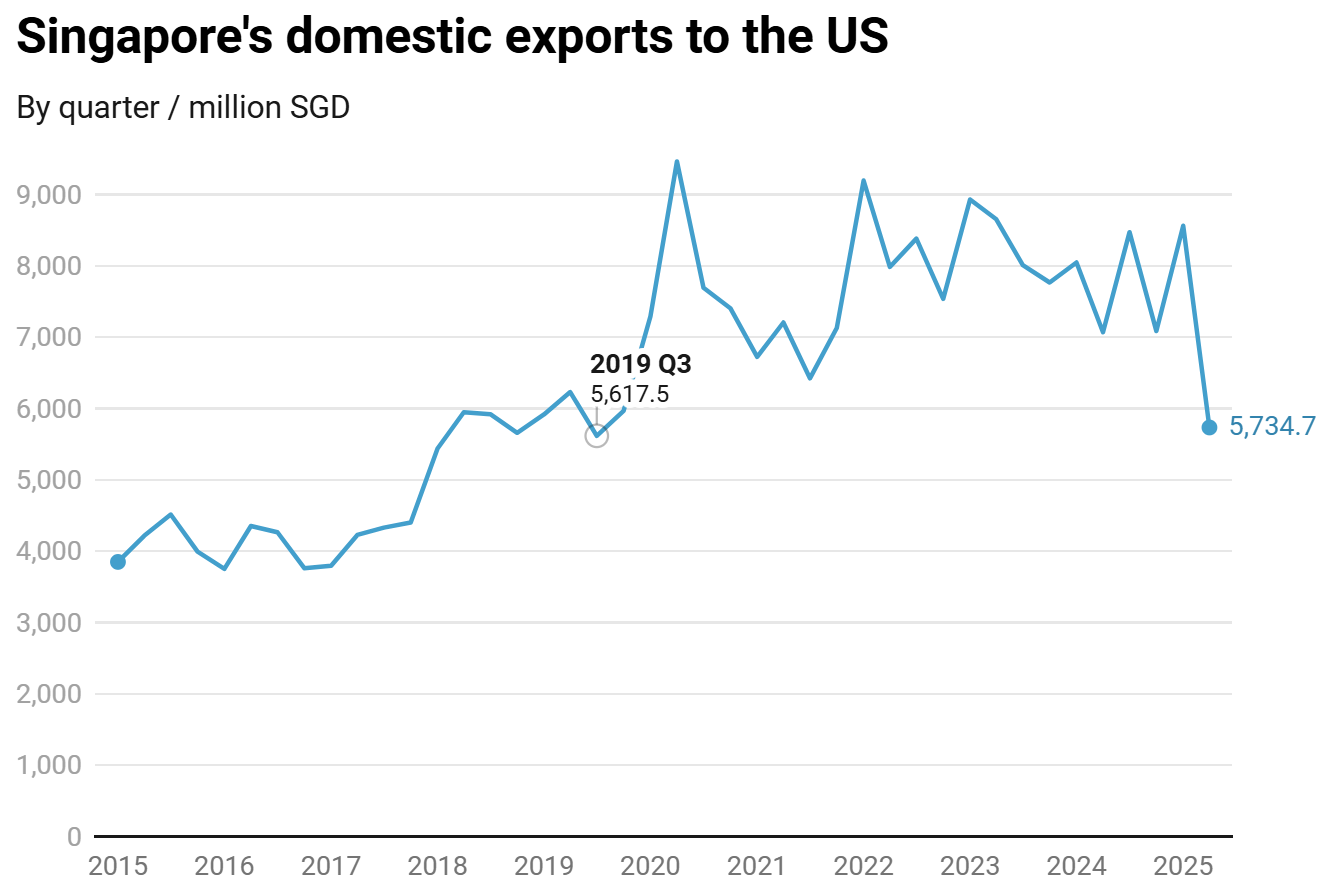

- Export Decline: Singapore’s domestic exports to the U.S. fell by 28% year-on-year between April and August 2025, with non-oil domestic exports dropping 11.3% in August alone. This reflects the immediate impact of the new tariffs on trade volumes.

- Economic Growth: Despite the export slump, Singapore’s economy grew by 4.3% year-on-year in the first half of 2025, partly due to front-loading of activities ahead of the tariff implementation. However, growth is expected to moderate in the second half of the year as these temporary effects fade and the full impact of tariffs is felt.

- Sectoral Effects: Export-oriented manufacturing, especially electronics and high-tech components, faces reduced demand and higher costs in the U.S. market. The financial services sector may also experience disruption due to its reliance on global capital flows linked to the U.S..

- Cost Absorption: Advanced manufacturers in Singapore have absorbed more than 20% of the tariff costs, while passing the remainder to customers. This contrasts with some other ASEAN countries, where none of the tariff costs are absorbed by exporters.

Interaction with the U.S.-Singapore Free Trade Agreement (USSFTA)

- Preferential Access: The USSFTA continues to provide tariff advantages for qualifying Singapore-origin goods, but exporters must ensure strict compliance with rules of origin to retain these benefits.

- Documentation and Compliance: Exporters must maintain thorough documentation to prove origin and may need to adjust customs classifications due to changes in U.S. tariff policies.

- Sector-Specific Exceptions: Some goods may not be covered by the USSFTA and will be subject to the new tariffs regardless of origin.

Strategies for Singaporean Exporters

- Supply Chain Optimization: Companies are reassessing and potentially relocating supply chains to mitigate tariff exposure. Digital solutions, such as advanced freight management software, are being adopted to enhance visibility, automate customs documentation, and optimize logistics.

- Cost Management: Businesses are considering passing on increased costs to customers and exploring ways to absorb part of the tariff impact to remain competitive.

- Leveraging FTAs: Firms are advised to maximize benefits under existing free trade agreements, including the USSFTA, by ensuring strict compliance with origin rules and staying updated on tariff schedules.

- Staying Informed: Given the potential for further sectoral tariffs (e.g., on pharmaceuticals and semiconductors), continuous monitoring of U.S. trade policy developments is essential.

Key Exemptions and Special Cases

- Exempt Goods: Pharmaceuticals, semiconductors, energy goods, critical minerals, certain IT products, and shipments under US$800 are exempt from the 10% baseline tariff.

- Partial Exemption: Goods with at least 20% U.S.-originating content by value are eligible for a partial tariff exemption—only the non-U.S. content is subject to the 10% tariff.

- Sectoral Tariffs: Automobiles, steel, aluminium, and copper face additional, higher tariffs regardless of the baseline rate.

Summary Table: U.S. Tariffs on Singaporean Exports (as of October 2025)

| Category | Tariff Rate | Notes |

|---|---|---|

| Baseline (most goods) | 10% | Exemptions for specific sectors and low-value shipments |

| Automobiles & Parts | 25% (Section 232) | In addition to baseline tariff |

| Steel & Aluminium | 50% (Section 232) | In addition to baseline tariff |

| Copper | 50% (Section 232) | In addition to baseline tariff |

| Pharmaceuticals, IT, etc. | 0% | Exempt from baseline tariff |

| Low-value shipments | 0% (<US$800) | De Minimis exemption |

Conclusion

Singaporean exporters face significant challenges due to new U.S. tariffs, with notable declines in export volumes and increased compliance complexity. While the USSFTA offers some relief, strict adherence to origin rules and proactive supply chain management are critical. Businesses are encouraged to leverage digital tools, optimize logistics, and stay abreast of policy changes to navigate this evolving trade landscape effectively.

WebSeoSG offers the highest quality website traffic services in Singapore. We provide a variety of traffic services for our clients, including website traffic, desktop traffic, mobile traffic, Google traffic, search traffic, eCommerce traffic, YouTube traffic, and TikTok traffic. Our website boasts a 100% customer satisfaction rate, so you can confidently purchase large amounts of SEO traffic online. For just 40 SGD per month, you can immediately increase website traffic, improve SEO performance, and boost sales!

Having trouble choosing a traffic package? Contact us, and our staff will assist you.

Free consultation