For e-commerce sellers, navigating GST, taxes, and compliance involves understanding registration thresholds, GST collection, reporting obligations, and import tax rules.

Key points for GST and tax compliance in e-commerce:

-

GST Registration: Businesses must register for GST if their annual taxable turnover exceeds SGD 1 million. For overseas sellers, registration is required if sales of low-value goods (under SGD 400) to local consumers exceed SGD 100,000 within 12 months and global sales exceed SGD 1 million.

-

GST Collection: Registered e-commerce businesses must charge 9% GST on taxable supplies to customers within the country, including physical goods and digital services such as software, e-books, and streaming. Overseas vendors supplying digital services must comply under the Overseas Vendor Registration (OVR) regime.

-

Import GST: Import GST applies to goods imported into the country, including low-value goods (under SGD 400), which are taxed at the point of import to level the playing field between local and overseas suppliers. Goods exported out of the country are zero-rated for GST, meaning GST is charged at 0% if conditions are met.

-

Tax Residency and Income Tax: The tax residency of the e-commerce business affects income tax obligations. Residency is determined by incorporation, management control, and central management location. Resident businesses are taxed on income earned locally and certain foreign-sourced income received locally, following a territorial tax system.

-

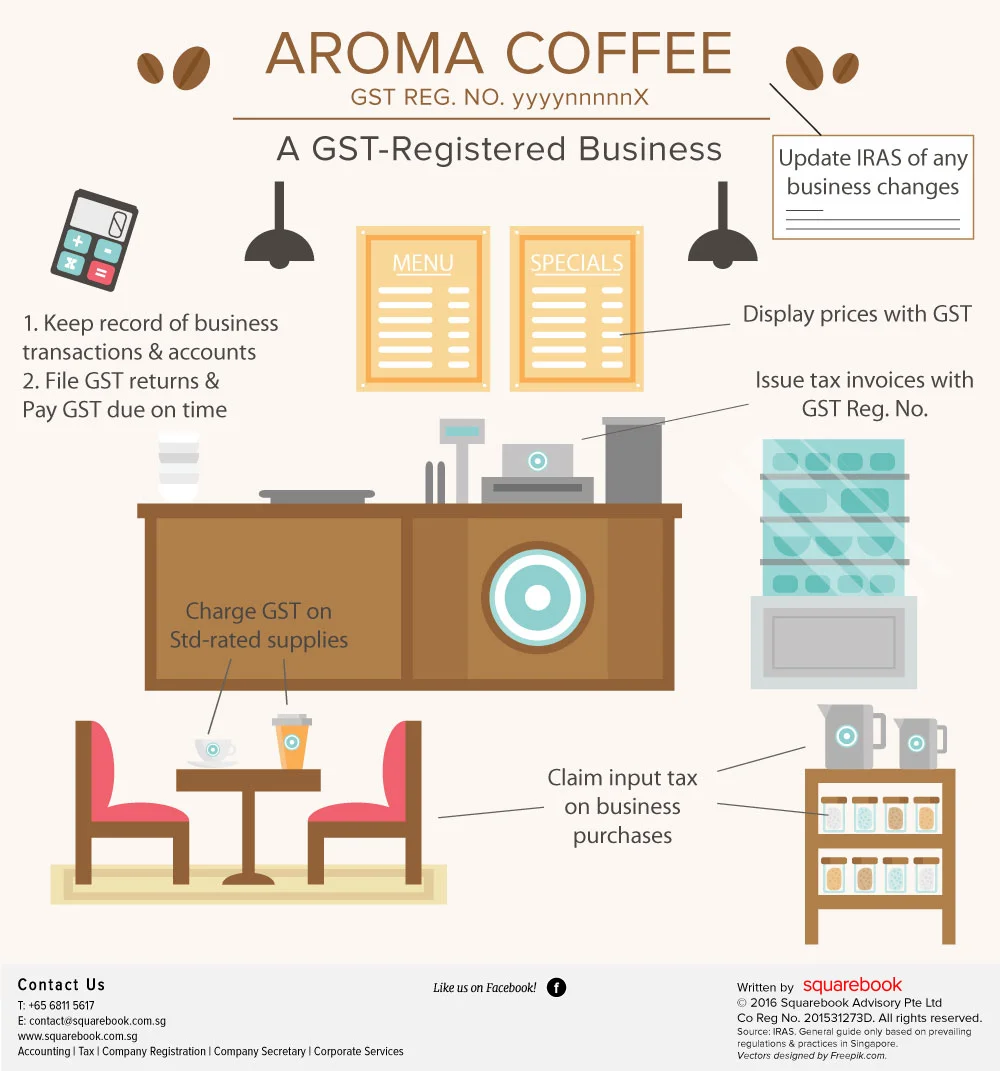

GST Reporting and Remittance: Registered businesses must file GST returns regularly and remit collected GST to tax authorities. For imports over SGD 400, GST is typically collected by customs or carriers, so sellers do not report these directly.

-

Voluntary Registration: Businesses below the SGD 1 million threshold may voluntarily register for GST to claim input tax credits on business expenses, which can be beneficial for those with significant costs.

-

Compliance Tips: Staying compliant requires accurate record-keeping, timely GST filings, understanding zero-rated and exempt supplies, and seeking professional advice for complex international tax matters.

In summary, e-commerce sellers must monitor turnover thresholds, register for GST when required, charge and remit GST on local sales, account for import GST, and understand their tax residency status to comply fully with tax regulations. This ensures legal compliance and smooth business operations in the e-commerce sector.

WebSeoSG offers the highest quality website traffic services in Singapore. We provide a variety of traffic services for our clients, including website traffic, desktop traffic, mobile traffic, Google traffic, search traffic, eCommerce traffic, YouTube traffic, and TikTok traffic. Our website boasts a 100% customer satisfaction rate, so you can confidently purchase large amounts of SEO traffic online. For just 40 SGD per month, you can immediately increase website traffic, improve SEO performance, and boost sales!

Having trouble choosing a traffic package? Contact us, and our staff will assist you.

Free consultation