Key analytics and performance metrics for insurance campaigns include:

- Customer Acquisition Cost (CAC): Total cost to acquire a new customer, crucial for evaluating marketing efficiency.

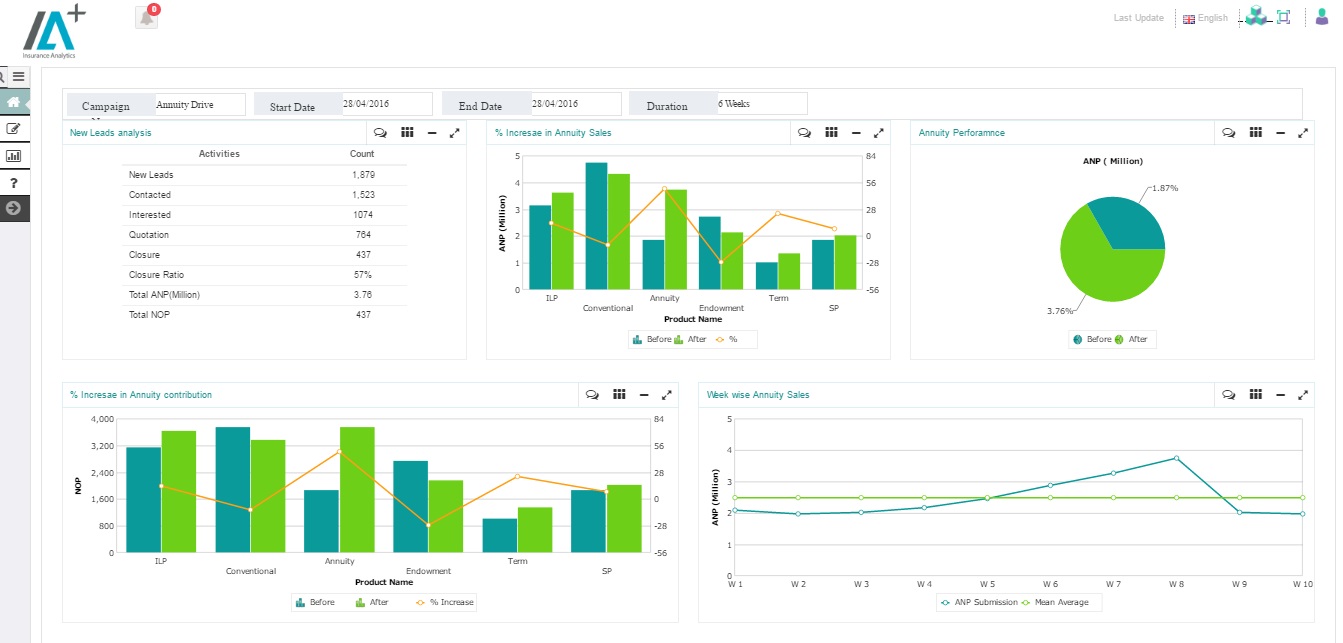

- Conversion Rate: Percentage of prospects who purchase a policy, indicating campaign effectiveness.

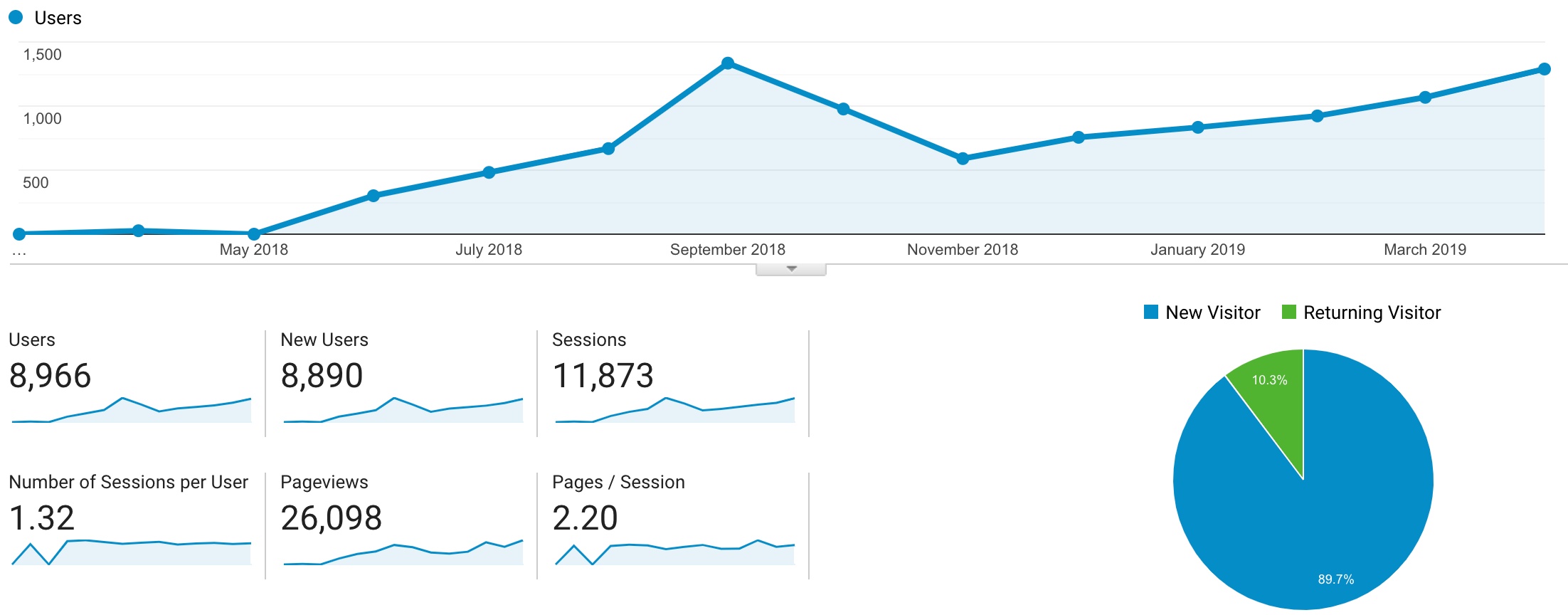

- Click-Through Rate (CTR): Percentage of users clicking on ads or emails, measuring engagement.

- Customer Lifetime Value (CLV): Expected total revenue from a customer over their lifetime, helping tailor retention strategies.

- Policy Renewal Rate: Tracks customer loyalty by measuring how many policies are renewed versus new policies issued.

- Average Policy Size: Average revenue per policy sold, useful for identifying upsell or cross-sell opportunities.

- Lead Metrics: Cost per Lead (CPL), Marketing Qualified Leads (MQLs), and lead scoring to prioritize high-potential prospects.

- Engagement Metrics: Email open rates, unsubscribe rates, social media likes, shares, comments, and website analytics such as bounce rate and session duration.

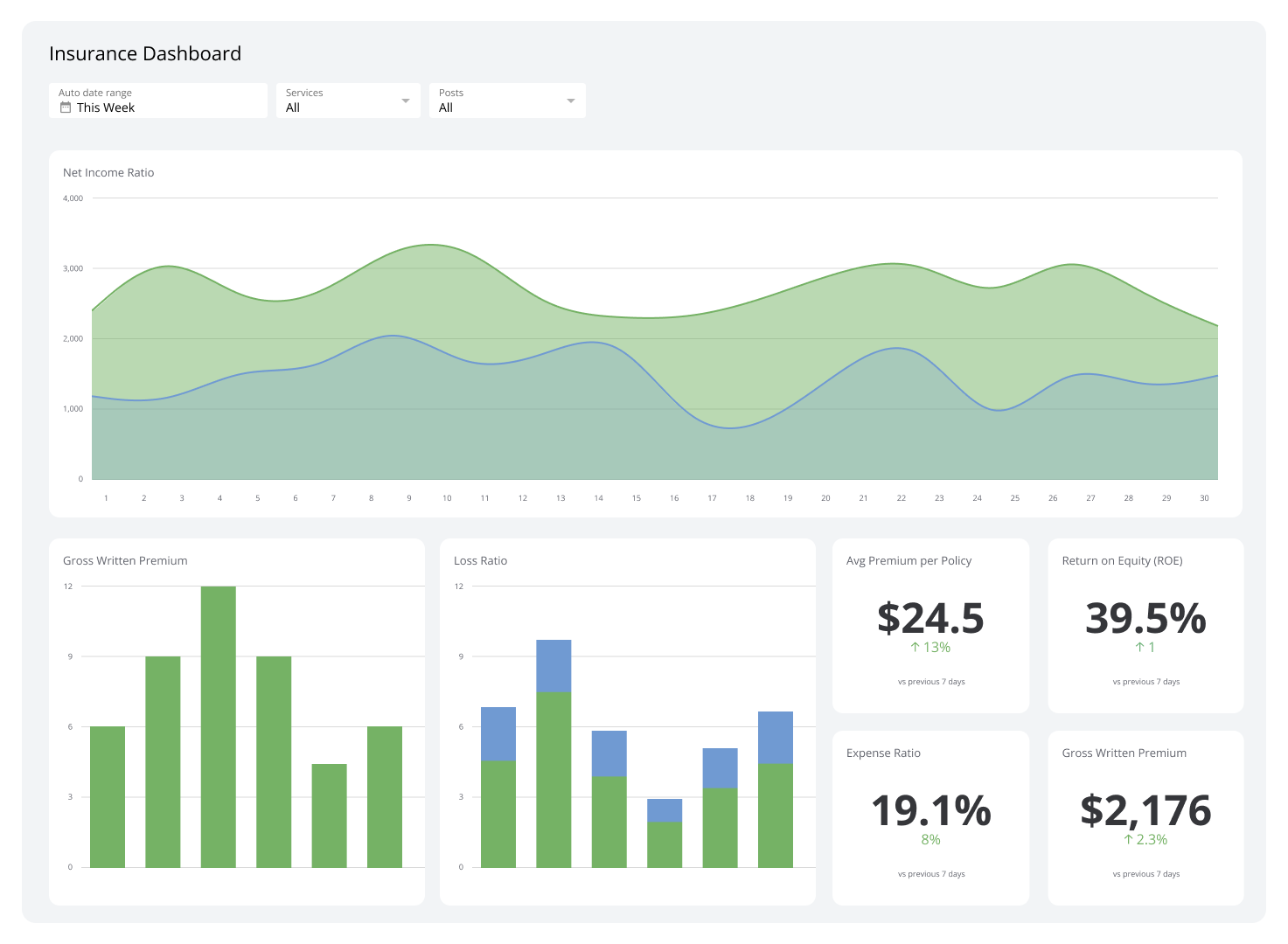

- Claims and Risk Metrics: Claim frequency, claims ratio, loss ratio, and expense ratio to assess underwriting performance and profitability.

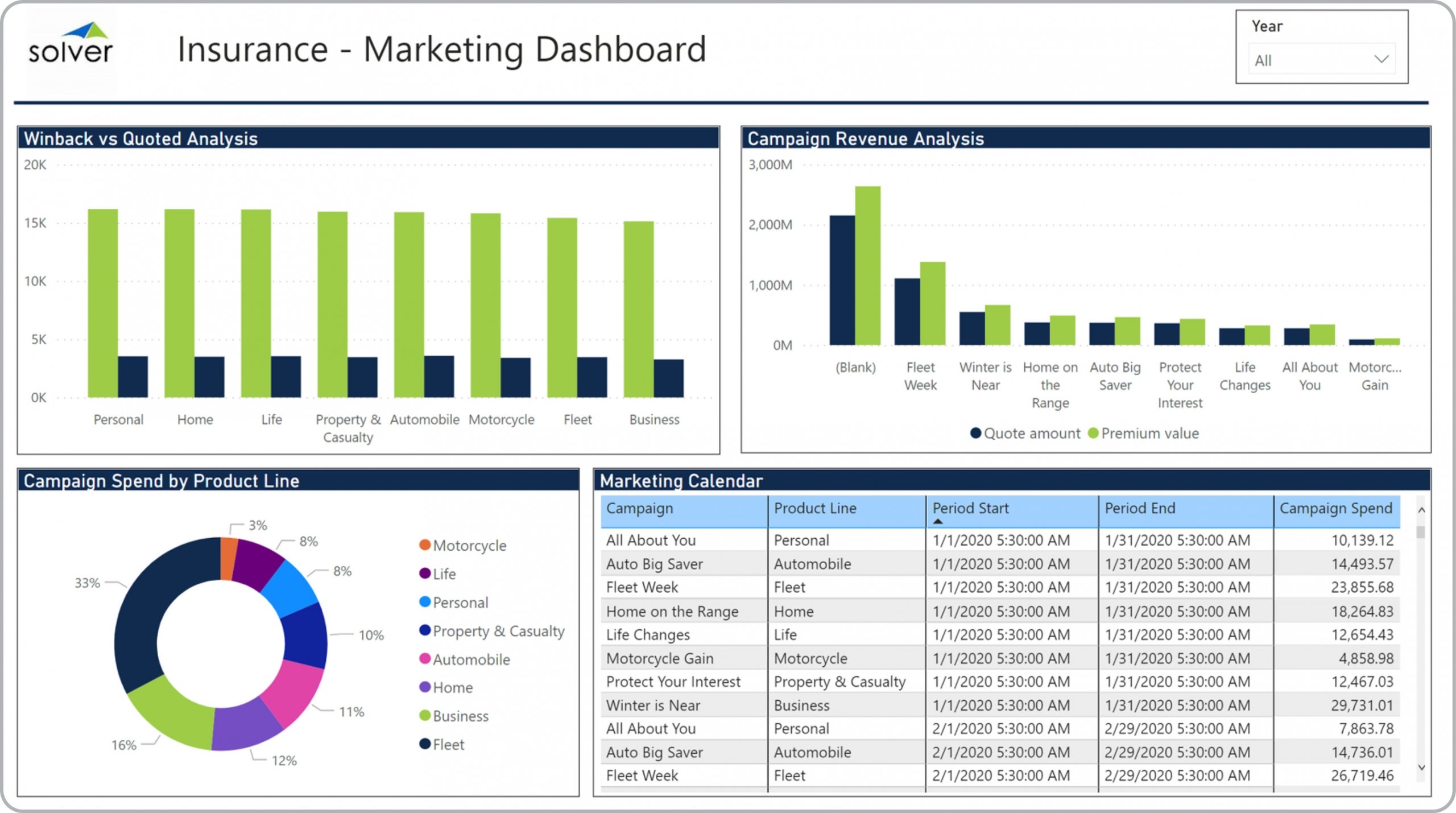

- Channel Efficiency: Performance of different marketing and distribution channels to optimize resource allocation.

- Revenue Per Customer: Average revenue generated per customer, indicating profitability and helping forecast financials.

- Sales Team Performance: Close rate (leads converted to clients) and average revenue per producer to identify coaching needs and high performers.

Additional insights:

- Advanced analytics and dashboards enable real-time tracking and predictive insights for underwriting, risk management, and marketing optimisation.

- A/B testing of ads, emails, and landing pages helps refine campaigns based on data-driven results.

- Automation and data accuracy improve compliance and operational efficiency.

- Using integrated analytics platforms (e.g., CRM, Google Analytics, marketing automation tools) supports comprehensive measurement and optimisation of campaigns.

These metrics collectively allow insurance companies to monitor campaign effectiveness, customer behaviour, operational efficiency, and financial performance, enabling continuous improvement and strategic decision-making.

WebSeoSG offers the highest quality website traffic services in Singapore. We provide a variety of traffic services for our clients, including website traffic, desktop traffic, mobile traffic, Google traffic, search traffic, eCommerce traffic, YouTube traffic, and TikTok traffic. Our website boasts a 100% customer satisfaction rate, so you can confidently purchase large amounts of SEO traffic online. For just 40 SGD per month, you can immediately increase website traffic, improve SEO performance, and boost sales!

Having trouble choosing a traffic package? Contact us, and our staff will assist you.

Free consultation